QuickFund: Access Your SR&ED Refund Quarterly to Fund Your Growth

Flexible, Founder-friendly Capital on Your Terms

Calculate Your SR&ED Refund

Estimate the value of your SR&ED Refund.

Get up to 64% of your R&D spend from the Canadian government as a cash refund.

Access Your SR&ED Refund Up To 12 Months Early So You Can:

- Re-invest in your business

- Grow faster

- Hire sooner

- Extend your cash runway

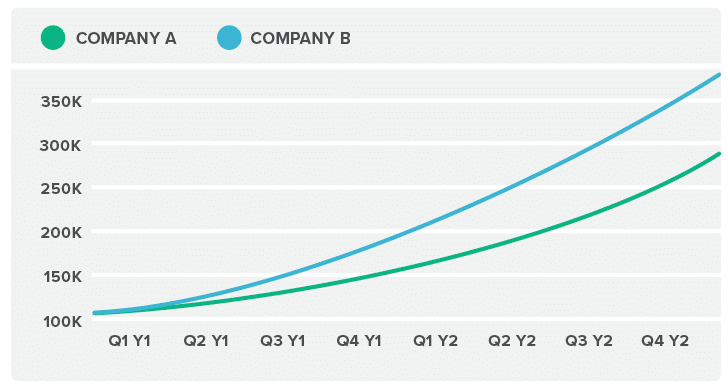

Companies that leverage QuickFund grow much faster than their counterparts

Since company B was able to leverage SR&ED Financing to get quarterly advanced funding, they were able to increase their growth rate one year ahead for Company A.

2 APPLY

3 GET FUNDED

4 GROW

How Would You Invest Your SR&ED Refund If You Got It Today?

Use our calculator to estimate the value of our quarterly advances and unlock your R&D expenses to improve your cash flow.

With our founder-friendly platform, it takes only one to two weeks to get funding.

Apply Now

One of the World's Largest R&D Tax Credit Software Companies

2011

1,000

120

$350M

Frequently Asked Questions

Q:What type of companies do you fund?

Q:Do you offer funding to pre-revenue startups?

Q:How much funding can I get?

Q:What information is needed to apply?

Q:How long does it take to get approved?

Q:What if my business has other forms of debt already?

Benefits of SR&ED Quarterly Advanced Refunds

Access Quarterly Advanced Refunds in Days with Boast

Unlike traditional SR&ED Financing models with financial institutions, Boast lends up to 75% of the quarterly accrued R&D expenditures to early stage, pre-revenue, high-growth businesses.

Additionally, Boast can provide this advanced funding as early as three months into the tax year (i.e., more than one year before the SR&ED claim is filed), which can dramatically—and positively—impact the growth trajectory of any business.

This non-dilutive capital extends the cash flow runway and provides the financial flexibility needed to make better decisions about scaling the business. The compounding effect of adding additional sales, marketing, and development resources 12 months early often leads to 1.5x higher valuation over a 24-month period.