Before applying for a tax credit under the Scientific Research & Experimental Development program (SR&ED) you should be aware of its requirements. But how does the Canada Revenue Agency (CRA) determine what qualifies and what doesn’t? In this guide, we’ll cover everything you need to qualify your work for SR&ED eligibility.

- Want to get straight to the questions? Skip to 9 Common Questions the CRA Uses to Determine SR&ED Eligibility

What is SR&ED? Understanding the Program:

Before we discuss the specific criteria you need to meet, we first should clarify what exactly is the SR&ED.

As per the CRA’s website, the Scientific Research & Experimental Development tax incentive program is designed to encourage Canadian businesses of all sizes to perform research and development within Canada.

The idea is that incentivizing these companies to innovate and make technological or scientific advancements, will in turn help Canada’s economic and competitive growth on the world stage. While the incentive is mainly targeted to Canadian-controlled companies, other companies, and even individuals can participate in the program.

FIND OUT IF YOU QUALIFY FOR SR&ED – FREE ASSESSMENT

What Are the Eligibility Criteria for the SR&ED Program?

As defined in the Income Tax Act, for income tax purposes SR&ED is defined in subsection 248(1) as:

- Basic research, meaning research done for the advancement of scientific knowledge without a specific practical application in view.

- Applied research, meaning research done specifically with a practical application in mind, also for the advancement of scientific or technological knowledge.

- Experimental development, meaning work done to achieve technological advancement to create new or improve existing materials, devices, products, or processes.

In other words, to qualify as SR&ED your work must show that it does the following:

- Technological Advancement – your work furthered scientific or technological knowledge as per the definition of a) and c).

- Technological Uncertainty – your work sought to face uncertainty due to a lack of scientific or technological knowledge for the given area

- Technical Content – your work went through an iterative process to try and overcome the challenges presented by said uncertainties.

It is important to note that even if your project does not succeed in its aim to overcome scientific or technological uncertainty, it can still qualify for SR&ED tax credits.

Guide to SR&ED Work Eligibility:

According to the CRA’s guidelines for Eligibility of Work for SR&ED Investment tax credits, they determine whether a project meets the criteria by asking two simple questions: Why the work is conducted and How.

The Why Question

As we have already established, your work must be to further scientific knowledge or achieve technological advancement. Since both are eligible for SR&ED, it doesn’t matter which one your work falls under. The important part is that you are doing it to advance science or technology.

But how do you know when new knowledge is needed? Well, when the current information is not enough to achieve a desired objective or result. This is where we run into the concept of scientific or technological uncertainty.

The recognition of this uncertainty is crucial for your work being recognized as SR&ED. Furthermore, your work must attempt to address this challenge. If you use existing knowledge to avoid this uncertainty problem, your work would not qualify.

Image by Diggity Marketing from Pixabay

The How Question

How your work is done is important to determine whether it can be considered SR&ED or not.

Your work must follow a systematic approach to the investigation and search for the advancement of scientific knowledge, and not just simply for the work itself.

If this sounds a bit confusing, let us clarify what a systematic approach to investigation would mean:

- Generating a hypothesis that uses known facts as a starting point to establish how to resolve a problem.

- Testing said hypothesis through experimentation and/or analysis.

- Developing conclusions based on the results of these experiments

- Logging the evidence that is created as the work is being done.

Bonus: click here to download this 20-page SR&ED Guide to learn everything you need to know to prepare a successful claim.

SR&ED Examples

Experimental Development

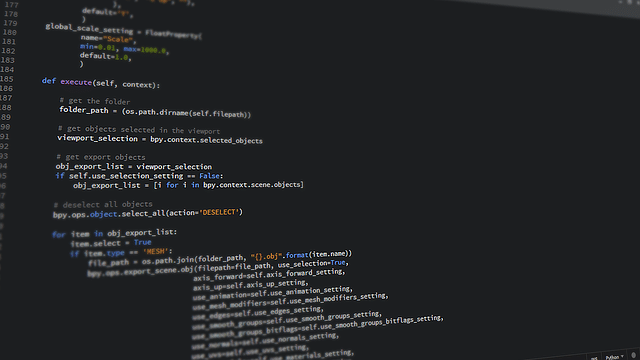

This category is by far the most commonly claimed type of work. This is work done in an attempt to create or discover technological knowledge to develop new or improved products or processes. Technological advancements, software developments, and research into artificial intelligence and machine learning usually fall under this area.

For software development, this could be achieving systematic advancement of currently integrated platforms. Another example using machine learning would be developing a new image recognition framework.

For artificial intelligence, it can be a little more difficult to claim SR&ED due to the misconception that it is mostly applied to training and doesn’t require experimentation. However, using A.I. to improve the capabilities of current algorithms through experimentation can qualify.

Image by Riekus from Pixabay

Basic Research

This is the type of research that is done solely to advance scientific knowledge, without a particular practical application in mind. Normally, this is done by universities, government laboratories, and other non-profit institutions. An example of basic research is the study of a new virus to understand its specific characteristics.

Image by Johnson Martin from Pixabay

Applied Research

Applied research work is very similar to basic research, the main difference between them being that applied research has a practical application in mind. An example of applied research would be utilizing the characteristics of a newly discovered virus to develop a vaccine.

Support Work

Traditionally, support work on its own doesn’t qualify as SR&ED. However, if it’s done specifically in support of basic research, applied research, or experimental development work that is done in Canada it can be considered part of it.

Image by WikiImages from Pixabay

Ineligible Work

The CRA has determined that not all work qualifies for the SR&ED. For clarity, they have lined out a list of the type of work that is considered excluded from the claim process. They are the following:

- Quality control or routine testing of products, devices, materials, and processes

- Sales promotion or market research

- Routine data collection

- Style changes

- Research in social sciences or humanities

- Commercial production of new or improved materials, devices, or products, or the commercial use of new or improved processes

- Prospecting, exploring, or drilling for, minerals, petroleum, or natural gas as well as their production

FIND OUT IF YOU QUALIFY FOR SR&ED – FREE ASSESSMENT

9 Common Questions About the CRA and SR&ED Claims

1) What is the deadline for corporations to submit an SR&ED claim? What about the deadline for individuals?

The deadline for corporations to file a claim is 18 months from the end of the tax year in which they incurred the expenditures for which they are filing the claim. If you are an individual, you have 17.5 months to file a claim.

2) What is the waiting period to receive a refund after filing the SR&ED claim?

As per the CRA’s current service standards, all claims which have been accepted the same way they were filed are processed within 60 calendar days after the receipt of the completed claim. For claims selected for audit or review, it will take 180 calendar days after the completed claim is received.

3) Is there an increased chance of being audited due to filing an SR&ED tax credit claim?

Not at all. The reviewers for the SR&ED tax credit are different from those that work with normal tax audit cases at the CRA. They will not pay attention to other aspects of your business that aren’t related to your claim.

4) Can a company that has not presented profits nor paid taxes yet be eligible for an SR&ED Tax credit?

As per the CRA guidelines, a company will be eligible for the tax credit as long as it is a Canadian-controlled private corporation. For corporations that don’t fall under these guidelines, they can still get a non-refundable tax credit for income taxes.

5) Is it possible to file a claim for both the SR&ED and the OIDMTC tax credits?

You can claim both provided that the costs that you are claiming are not the same. If you check the FAQ page for the OIDMTC, you’ll see that you are not able to claim labor costs for it if you already did for the SR&ED credit. In addition, you should consider claiming the SR&ED first as it traditionally processes faster and gives you a bigger refund.

6) Can a company that already received funding from the IRAP still claim an SR&ED tax credit?

You can still receive the tax credit, however, the IRAP funding you received will be deducted from it.

7) What if the project was unsuccessful? Can a claim for an SR&ED tax credit still be filled?

Yes. A project will qualify for the credit even if it was abandoned, postponed, or failed to meet its goal, so long as the company can prove it intended to make a technological advancement on the project.

8) Are we still eligible for an SR&ED tax credit if other products exist that are similar to our own?

This is a tricky area, so the answer isn’t a plain yes or no. It depends on whether or not the project constitutes a development in the context of your business. Two companies might be trying to reach the same goal, but they could go about it in different ways. You can make a project based on something that already exists if you add something to it to make it new or adapt current processes in a new way.

9) Can a company still get an SR&ED tax credit even if most of the work on research and development is done by contractors?

It depends. You need to own the work for which you are filing a claim, and the CRA stipulates that a Canadian contractor must be at “arm’s length”, meaning that you cannot be related to them or control them in any way.

Still scratching your head?

If you are still unsure whether your work qualifies for the SR&ED tax credit after reading this guide, don’t worry. We will be happy to help answer all your questions. Contact us and we will give you a complimentary SR&ED assessment where we go over your project and see if it meets the criteria to be known as SR&ED.