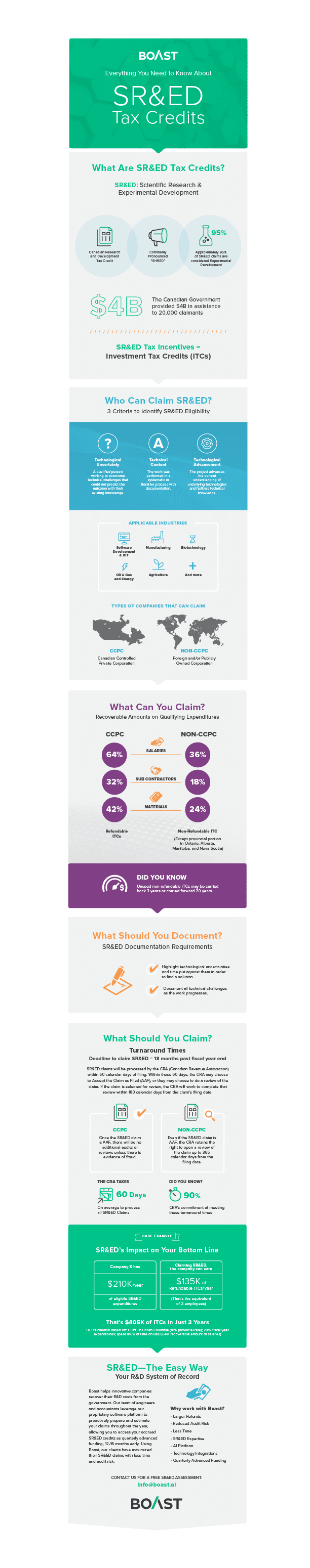

The Scientific Research & Experimental Development (SR&ED) tax credit is Canada’s most popular R&D funding program. Annually, this program provided $4B to over 20,000 companies in Canada. We know that this program can seem complicated for first-time claimers so we attempted to simplify it into an easy-to-read infographic.

If you have any questions, get in touch with us! We are more than happy to explain the program in more detail for your unique needs.

(Click infographic to open in a new tab)

Want to share this image on your site? Please include attribution to https://boast.ai. Thank you!