A critical step to launching a business is building the product, or at least the minimum viable product (MVP). Without an MVP, you may not be able to raise capital nor can you even think about growth or scaling. The product comes first.

Since you can’t magically produce that MVP from your head, it’s going to take you hours of tweaking and fixing, and some extra help.

To qualify for SR&ED tax credits, you must show that you attempted to advance technology, you faced challenges and you either achieved your desired outcome or you didn’t (don’t worry, this is okay too).

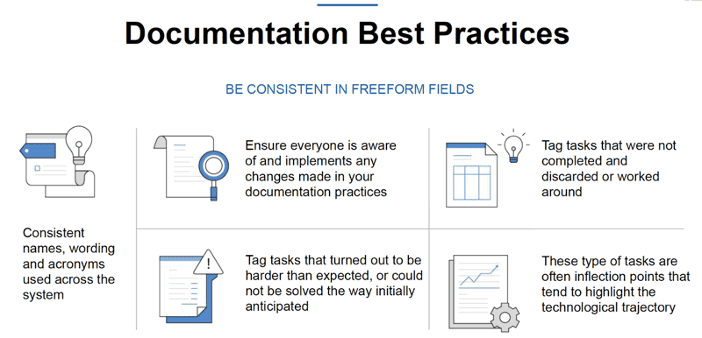

The critical step you must take during this testing phase is to document all the challenges you come up against.

Documentation is extremely important so that you can support your claim, regardless of its size. Document your progress, highlight your challenges, and prove that you and your team went through a systematic process to overcome those challenges.

If you don’t document those challenges, how are you going to substantiate the work your team performed as required for a successful SR&ED claim?

SR&ED Documentation Requirements

In the event that your SR&ED claim is flagged for an audit, they will ask you to provide evidence to substantiate the claim. The CRA requires two forms of supporting evidence: support for the SR&ED work conducted and support for the SR&ED expenditures claimed.

1. Support for SR&ED Work Conducted

This documentation includes anything that proves the full scope of the R&D work that was conducted, how it was carried out, when it was performed, etc. We suggest that any documentation you keep should be dated, signed, and specific to the work performed, as per the CRA’s recommendations.

Note: If you choose to use supporting evidence that was produced after the specific project has been carried out, the CRA requires you to ensure that the evidence accurately reflects the project in Part 2 of Form T661.

2. Support for SR&ED Expenditures Claimed

Essentially, we recommend that all your supporting documentation should:

- Be contemporaneous, which means that it is documented at the time the SR&ED work is being performed.

- Be dated to prove that the work occurred in the fiscal year you are claiming.

- Highlight technological uncertainties and time put against them to find a solution

These requirements seem simple and straightforward, but can actually be difficult for some teams to stay on top of and record diligently. This is especially true when it comes to software development teams using an agile method to iterate.

The good news is that if your team is leveraging project management software such as Jira, Trello, Asana, and code repositories such as Github, Bitbucket, and Gitlab, you are probably already doing half the work you need for gathering documentation.

With a few simple tweaks, you can easily take advantage of your technical team’s existing process to capture the information needed to complete a SR&ED claim.

Forms of Documentation

Here are common forms of documentation (that you are hopefully already using) that can be used to support your software SR&ED claims:

- Timesheets – all employees involved in R&D should track 100% of their time as well as separate SR&ED and non-SR&ED eligible activities. This will allow the percentage of time spent on SR&ED to be calculated accurately. Include notes in timesheets on activities and technical challenges encountered.

- Technical challenges – maintain records on technical challenges faced during development. Include detail on experiments conducted, prototypes created, iterations, testing, and analysis of test results. Include specific metrics as appropriate (i.e. performance was greater than 5 seconds when the limit was 1 second; memory usage was X with only 10 concurrent users). This could be done weekly or bi-weekly.

- Version control for all technical documents – use in architecture documents, design documents, as well as source code to track the evolution of the system. Include notes on technical issues when checking files into the version control system.

- Software prototypes – save prototypes (possibly in the version control system) and include notes on the analysis of the prototype.

- Test documents – save test cases, results, and analysis. Include dates and who performed the testing.

- Developer Notebooks – keep all handwritten developer notebooks. Have them include dates on the notes.

- Meeting minutes – include the date, attendees, duration of the meeting, point form descriptions of technical issues discussed.

- Whiteboard photos – take pictures of software designs created on whiteboards and save with project documentation.

- Emails – track email exchanges with labels when relevant challenges were discussed.

In other industries, you can also include product prototypes and associated materials, and engineer notebooks.

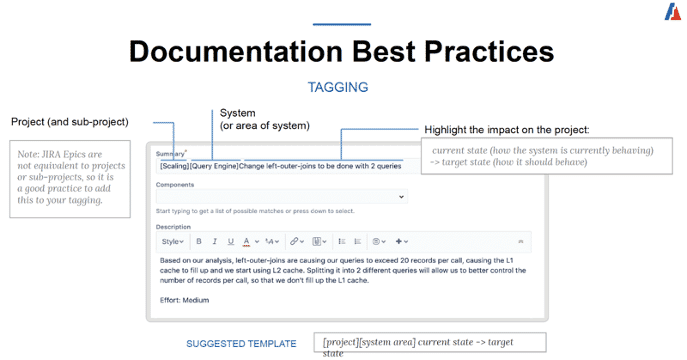

What should I be capturing in my Jira descriptions that will help with my SR&ED claim?

The CRA is looking for details on the technical challenges faced during the research & development phase, so include details on experiments conducted, prototypes created, iterations, testing, and analysis of test results.

Additionally, your team should also include specific metrics as appropriate (i.e. performance was greater than 5 seconds when the limit was 1 second; memory usage was X with only 10 concurrent users, algorithm accuracy is x when we tested with y variables).

However, maybe your team isn’t big enough and perhaps the step-by-step process we outlined above sounds like a lot of overhead to capture SR&ED. Not a problem – this is not a one size fits all process and we’ve put together for you industry averages based on our user base to help guide you to the right solution for your business.

I. R&D Team Size: 1-3 developers

Use Microsoft Excel or Google Sheets and GitHub. Yes, Excel & Google Sheets are absolutely fine for a small team since the CRA doesn’t expect you to spend money on an expensive project management tool. Small teams are nimble and can easily collaborate in a GSheet.

II. R&D Team Size: 4-7 developers

For a team of 4-7 developers, we recommend using the basic version of Jira and Github. Once your team grows over 3 developers, it’s likely time for you to leverage a project management tool, instead of relying on Excel or Google Sheets.

While there are lots of tools out there, we’ve found that 50% of our clients tend to use the Jira + Github tech stack. However, your team can also explore tools like Trello, Gitlab, Notion, and Asana.

III. R&D Team Size: 8+ developers

It’s time to start using Jira (with story points) and Github once your team grows to 8+ developers since your team must start effectively managing and planning sprint cycles. Atlassian recommends that you use story points to help plan, manage, and create transparency around your product development work.

Step-by-step Approach to Tracking Your Technical Documentation

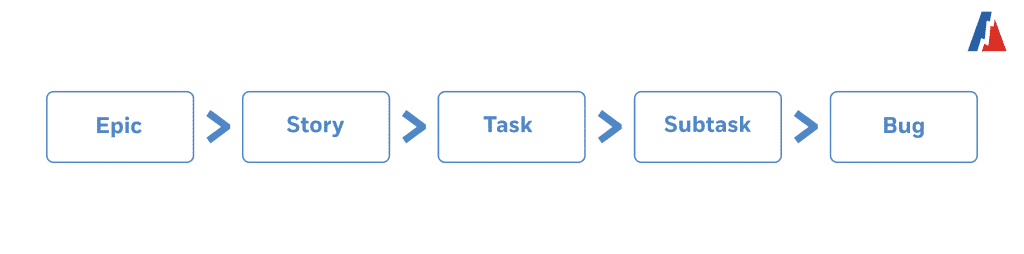

Step 1: Leverage the natural hierarchy of your project management systems

Using this data structure allows you to understand who is working on what and how your organization is delivering new and innovative products.

By leveraging the information data structure that Atlassian recommends, you are not only helping prepare for your SR&ED claim but you are increasing development velocity, development transparency, and development communication across your company as you scale.

Step 2: Assign Jira story points to your sprints

If you’re using an agile development methodology, then assigning Jira story points to your sprints will not only help you prepare and deliver against your goals and objectives but it also serves as a time tracking tool for your SR&ED claim.

We recommend following a simple 15 point per sprint agile methodology since it will give your team accurate time estimates that will substantiate your SR&ED claim to the CRA in the event of an audit.

Step 3: Leverage your code repository for version control.

This is obvious to most, but this actually also serves as evidence for your SR&ED claim. By simply referencing your Jira ticket number in your Git commit you are creating an audit trail that will stand up to the most rigorous CRA audit.

Step 4: Allocate story points

Your team should allocate story points to quality assurance, project management, and resource management to increase the SR&ED claim and reduce overhead costs. While these resources are not traditionally captured in Jira, creating a task associated with every sprint actually serves as technical evidence for your SR&ED claim.

Step 5: Data integration

Integrate your data with a SR&ED software platform (e.g. Boast.ai’s AI-powered software) to automate the manual tasks, such as time-tracking, automatic categorization of service tickets & epics to the associated projects, etc.

Step 6: File your SR&ED claim and get your money!

Once it’s time to file for your SR&ED claim, you can begin to prepare the full technical write-up required by the CRA. If you choose to work with Boast.ai, we have a full team of in-house technical SR&ED tax experts who will prepare the full SR&ED claim on your behalf.

Once we have prepared everything, all your team has to do is approve the reports and wait for the CRA to process your SR&ED refund.

SR&ED Documentation Tips

We don’t like to tell companies how to record their work as we find each and every organization and team handles documentation differently. We can, however, provide some successful tips that we’ve experienced during the claiming process:

- Don’t underestimate the importance of challenges and notes captured in emails.

- Start recording early, even if you aren’t sure if your work is SR&ED eligible yet.

- Schedule reminders to create notes in your project management system.

- Schedule reminders to record your time at the end of every day.

- For software companies, record notes on the source code itself.

- Enlist an internal champion to oversee the process.

So do you really have to document your SR&ED eligible work? Yes, you do. And the more you do, the better your SR&ED claim will be.