Fundraising for a startup is undoubtedly one of the biggest challenges faced by any Founder today. While there are multiple avenues they can leverage to raise capital (e.g. venture capital, convertible notes, bank loans, etc.), the fundamental question every Founder must ask themselves is whether they want to give up equity or take on debt.

There are pros and cons to consider for both equity and debt; with equity, you have to give up a portion of your company in exchange for the capital you receive but by taking on debt, you’re facing significant pressure in paying the loan back with interest.

In the past five years, startups in Canada have exploded, and given the significant investments proposed as part of the Federal 2021 Budget by the Canadian government, the Canadian startup ecosystem is headed for a meteoric rise. This means that Founders are going to find it harder than ever to raise capital.

While fundraising through venture capital or private equity firms can seem attractive, what many Canadian startup Founders don’t realize is that it’s extremely unrealistic to avoid debt on their cap table, especially if they are gearing to secure a Series A fundraising round.

One form of debt that is often overlooked is non-dilutive funding, such as a form of SR&ED Financing. Instead of having to wait 12-16 months to get their SR&ED refund and wait until it can be re-invested into the company, you can receive your refund in the form of a cash advance that you can start to use right away.

Traditionally, as your company performs research and development activities over the course of the year, you are accumulating SR&ED tax credits and building up an asset. The problem is that you’re not able to unlock that asset until you submit your taxes and get your refund check from the CRA, which typically ends up being 9+ months from the end of your fiscal year.

With Boast.ai’s Quarterly Advanced Funding, you can expect to your get the cash advance quarterly against your company’s accrued SR&ED tax credits as collateral, instead of having to wait until you submit your tax returns and get a response from the CRA.

For Founders who are wary of taking on debt during their pre-seed or seed stage, you should remember that any optimal capital stack will include both equity and debt, especially if your company is doing SR&ED-eligible R&D projects.

However, it’s understandable that many Founders can have questions related to non-dilutive funding, so we’ve answered some through our FAQ.

How Quarterly Advanced Funding Accelerates Your Growth

what is the best avenue for fundraising as a startup, debt or equity?

Non-Dilutive Funding FAQ

1. Why should my business go into debt over offering equity?

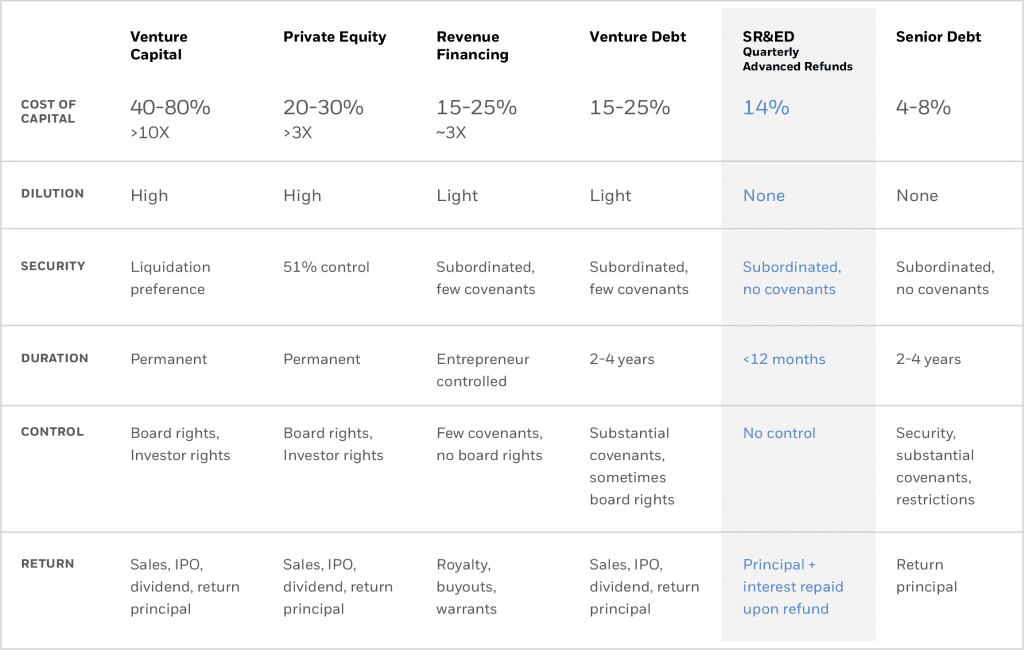

There are a lot of upsides in using SR&ED Quarterly Advanced Refunds. Compared to the 20-30% interest rate for equity, the interest rate for SR&ED Financing is only 14% with an effective interest rate of approximately 8%. More importantly, Founders maintain full control over company operations and when it comes to returning the capital, you only have to return the principal and the interest once you receive your SR&ED refund.

To understand how non-dilutive funding (e.g. SR&ED Quarterly Advanced Refunds) compares to other forms of debt and equity, take a look below.

2. What if my business has other forms of debt already? What will the repayment structure look like?

Our Quarterly Advanced Refunds offering is subordinated to your other debt obligations and has no covenants. It’s similar to a rolling line of credit where the principal and interest are accrued and paid back only once the SR&ED refund hits your bank account.

3. Can’t I just go to a bank to get any loan for my business?

Senior debt or Bank debt is harder to qualify for and typically requires a monthly recurring revenue (MRR) greater than $150,000. It can also include a personal guarantee and is always senior in terms of creditor priority on assets of the company.

4. How soon after the quarter-end can we receive the advance?

If you choose to engage Boast.ai, you will be able to access your Quarterly Advanced Refund within the first couple of days of the new quarter. Our proprietary platform integrates with your tech stack which allows our team to capture insights and estimates of your quarterly SR&ED eligibility.

5. What is the cost of SR&ED Quarterly Advanced Refunds?

The posted cost of the SR&ED Quarterly Advances Refunds is a 14% annual interest rate, compounded monthly. However, because the principal is only outstanding for 6 months on average, the effective interest rate is 7-8% calculated as interest cost / total principal.

6. What dilution should I expect from SR&ED Quarterly Advanced Refunds?

Unlike SAFEs, Convertible Debentures, Equity, and even Venture Debt, SR&ED Quarterly Advance Refunds has ZERO dilution associated with it.

7. What security is required for SR&ED Quarterly Advanced Refunds?

The SR&ED quarterly advance is secured by the SR&ED refund itself with no personal guarantees. A general security agreement registered under the PPSA (subordinated) and an Intercreditor Agreement with all other secured lenders providing first priority on proceeds from SR&ED Refunds. Convertible debt holders are required to subordinate security on all assets.

8. What kind of control do I give up with SR&ED Quarterly Advanced Refunds?

Unlike SAFEs, Convertible Debentures, Equity, and even Venture Debt, SR&ED Quarterly Advanced Refunds has ZERO control associated with it with no covenants required.

9. How do I pay off the SR&ED Quarterly Advanced Refunds?

The principal, interest, and advance fees are paid directly from the SR&ED refund with no intermittent payments and no prepayment penalty, meaning you can pay off the existing principal and interest at any time.

How Quarterly Advanced Funding Accelerates Your Growth

what is the best avenue for fundraising as a startup, debt or equity?

If you have a question we didn’t address in our FAQ above or to learn more about our SR&ED Quarterly Advanced Refunds offering, contact us for a free assessment.