A better approach to SR&ED Tax Credits

BoastClaim™ SR&ED

Boast brings a complete solution to maximize your tax incentive claims and eliminate the difficulty and mystery of traditional offerings.

AI-powered Software

- Payroll

- Accounting

- Jira

- Github

The Boast platform gathers data from your technical and financial systems to identify and categorize eligible projects, time, and expenses—estimating along the way instead of only at the end—and getting you more money, faster, for less time, and risk.

- Time Tracking

- Cash

- Audit Evidence

- Tax Forms

Ready for Data

Your data—and lots of it—is the key to a more accurate claim. Good thing the Boast platform is hungry for data. We securely integrate with hundreds of other systems to make capturing and qualifying your SR&ED investments easy, and real-time.

A Proven Process, Without the Mystery

SR&ED Tax Specialists Have Your Back

In-house experts prepare and validate your claim, applying their collective decades of experience in finance, tax, and technology to maximize your eligibility. Regular check-ins throughout the year mean you are always making the most of your innovations without the end-of-year deadline scramble.

Be Confident—And Be Ready

Audits happen—even to the most accurate claims. Boast experts and software combine to create maximized claims that stand up to audits. Boast wins 2x the industry average in audits, and because of our technology, and our proven process, you are audit-ready as soon as your claim is submitted. Every part of our process makes you confident—we call that Boast AuditShield.

The Ultimate Guide to Claiming SR&ED Tax Credits

Annually, over $4.1B CAN is provided in assistance to 20,000 claimants. There is no tax credit cap for the overall funding under the CAN Tax Act.

Access Your SR&ED Refund Up To 12 Months Early So You Can:

- Re-invest in your business

- Grow faster

- Hire sooner

- Extend your cash runway

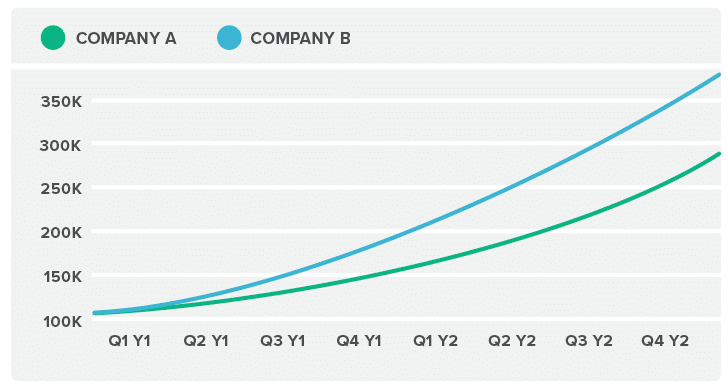

Companies that leverage QuickFund grow much faster than their counterparts

Since company B was able to leverage SR&ED Financing to get quarterly advanced funding, they were able to increase their growth rate one year ahead for Company A.

Find Out How Much Money You Can Get From The Government

Your free 1-hour consultation includes a detailed review of our platform, your projects, processes, and financial data by one of our R&D Tax experts.

Talk to one of our experts to see how outsourcing your R&D tax claims to Boast can get you more money back from the government and help you regain the time you need to run your business.

Fill out the form to schedule your demo.