Boast, the Leading R&D Tax Credit Solution, Names Imad Jebara as Chief Executive Officer

March 26, 2024

March 26, 2024

March 26, 2024

Boast hires new CEO to accelerate its transformation into the R&D System of Intelligence.

AI, Artificial Intelligence, CEO, funding, growth, Product, senior leadership, SLT

October 30, 2023

In the dynamic world of startups, innovation is the lifeblood that propels companies forward. Research…

federal budget, funding, Government Funding, growth, playbook, SRED Resources, startup, startup resources, strategy, United States

October 24, 2023

Former Galvanize Vice President to manage all aspects of software-as-a-service product innovations TORONTO, Oct. 24, 2023…

AI, Artificial Intelligence, funding, growth, Product, senior leadership, SLT, VP of Product

August 15, 2023

Leading R&D and Tax Credit Intelligence Platform Redefines Data Ingestion by Using Advanced AI Capabilities…

AI, AI Classifier, Artificial Intelligence, growth, product feature, product release, technical analysis

May 6, 2022

Fast Company’s World Changing Ideas Awards honors ideas that make the world a better place.…

May 5, 2022

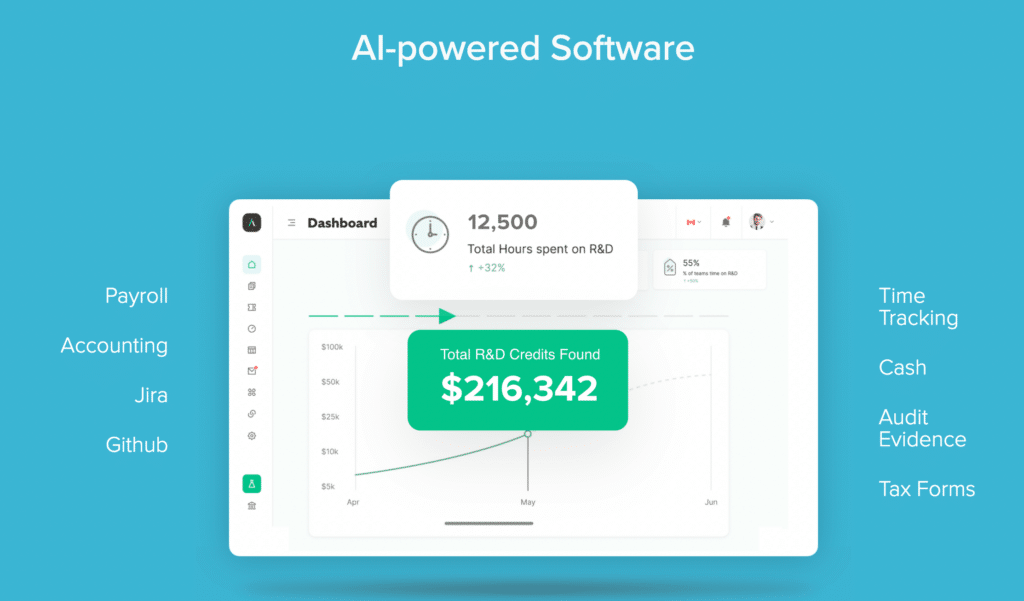

Boast, a fast-growing fintech company that helps businesses automate the cumbersome process of preparing and…

March 15, 2022

—Clients get faster claim preparation and accuracy with 30 new data integrations, instant time estimates,…

March 4, 2022

Boast wins award for Best Specialist Tax Credit Software Firm, 2022, Canada, by Acquisition International…

February 13, 2022

R&D tax leader Boast rebrands. Boast’s mission is to help companies innovate faster through tax…

February 7, 2022

—110,000 members can now consume content in podcast format for convenience, tapping into advice from…

February 7, 2022

—Commitment represents a massive burden to companies, and the status of new U.S. law leads…